Being in a car accident is bad enough when the other driver has insurance. If they don’t, you’re probably worried about how you’ll pay for the consequences, from repairing your vehicle to treating your injuries to making ends meet while you’re too hurt to work. Fortunately, you could have options available to you, including through your own insurance policy—and Ted A. Greve & Associates, P.A., can help you pursue them. Contact us today for a free consultation with an uninsured motorist lawyer in Charlotte, and let us assert your right to fair compensation.

Understanding Uninsured Motorist Claims in Charlotte

Let’s explore what you need to know about uninsured motorist claims in Charlotte, NC.

The Risks of Uninsured Drivers on the Road

In North Carolina, the driver responsible for a car accident must pay for its consequences. That’s why the state requires that all motorists carry liability insurance, which covers the costs of injuries and property damage the policyholder causes others. Unfortunately, not everyone follows the law; the Insurance Information Institute estimates that about 1 in 10 North Carolina drivers are uninsured. When these uninsured drivers get in accidents, they lack the funds necessary to pay for the damage they cause.

Fortunately, in addition to liability insurance, North Carolina also requires drivers to carry uninsured motorist coverage. These policies come into play when the insured is injured by a driver who lacks necessary coverage. In other words, if you’re a driver in North Carolina, you should already be protected from uninsured drivers by the policy you already carry.

The Importance of Seeking Legal Advice

While North Carolina law means you are likely already covered in the event of an accident with an uninsured motorist, it’s important to remember that your insurer is not on your side. Rather, it is a business interested in protecting its profits whenever possible, even if that means denying your claim or minimizing your payout. Moreover, it has a team of lawyers it will deploy against you should you question its decision attempt to take it to court.

Don’t make the mistake of going up against these powerful interests alone. Instead, fight back with the help of your own uninsured motorist lawyer. The team at Ted A. Greve & Associates, P.A., can:

- Investigate the accident to prove the other driver’s fault

- Review your insurance policy for details of coverage

- File your claims on your behalf to start the legal process

- Negotiate aggressively for a settlement that pays you fairly

- Take your insurer to court if it attempts to minimize your payout

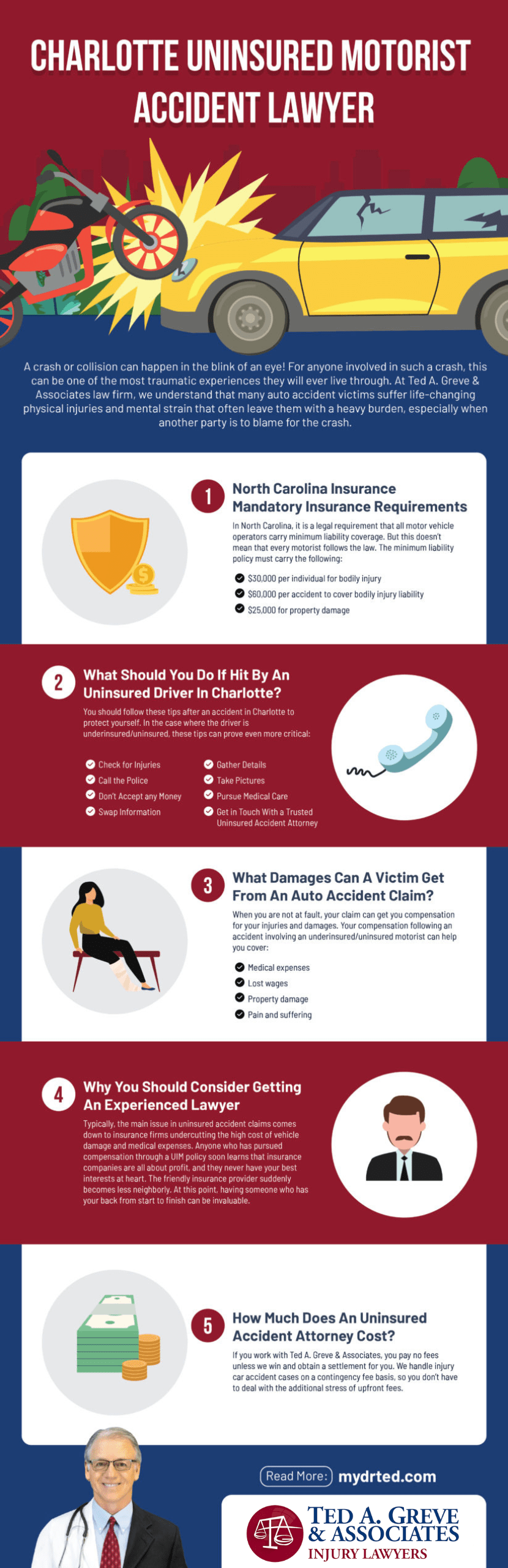

We’ll do all this at no upfront cost to you, instead only collecting our fee if and when we win. So don’t wait to put us in your corner—contact us today for a free consultation with an uninsured motorist accident attorney.

Navigating Uninsured Motorist Laws in Charlotte, NC

Hurt in an accident with an uninsured motorist in Charlotte? Here’s what you need to know about navigating the relevant laws and seeking fair compensation for what happened.

Uninsured and Underinsured Motorist Coverage in Charlotte, NC

North Carolina law requires all drivers to carry uninsured motorist (UM) insurance. Assuming you have auto insurance, you should automatically have this provision in your coverage. UM coverage will pay for injuries and property damage caused by an at-fault, uninsured driver, up to your policy limits. Basic policies must cover at least:

- $30,000 in bodily injury per person

- $60,000 in bodily injury per accident

- $25,000 in property damage per accident

If you have more than the minimum coverage, you should also have underinsured motorist (UIM) coverage on your policy. This applies to accidents caused by drivers who have insurance, but whose insurance limits are insufficient to pay for the injuries they cause. Your UIM insurance makes up the difference between what the at-fault driver’s policy will pay for and your own policy’s limits. Note that UIM insurance will pay for injuries but not property damage.

Steps to Take After an Accident with an Uninsured Driver in North Carolina

Here’s what you can do after an accident with an uninsured driver to protect your rights and seek fair compensation.

Immediate Actions Post-Accident

What you do in the immediate aftermath of the accident can help you protect your rights and your well-being. Here’s what to do if possible:

- Get yourself and any passengers to safety

- Alert authorities to the accident

- Take photos of the scene and any injuries if safe to do so

- Seek medical treatment immediately, even if you feel fine

Next, take the following important steps.

Filing a Police Report and Notifying Your Insurance

If you contacted police at the scene, they should have created an official report of the accident. This document can serve as valuable evidence for your uninsured motorist claim, as it contains details that could aid in a thorough investigation and point toward liability.

Also, be sure to notify your insurance provider of the accident, ideally within a few days. Late notification could jeopardize your coverage.

When to Contact an Uninsured Motorist Lawyer

While it’s always a good idea to contact a lawyer after an accident with an uninsured driver, here are a few indications that it might be critically important for you to do so:

- Your insurer disputes the other driver’s liability

- Your insurer requests additional information to process your cliam

- Your insurer makes you a quick settlement offer

How an Uninsured Motorist Lawyer in Charlotte Can Assist You

Remember, your UM policy will only cover the accident if the other driver was at fault. As such, your insurer might use any confusion or lack of clarity on this point to deny your claim.

Evaluating Your Case and Potential Compensation

Most uninsured accident attorneys in Charlotte, NC—including Ted A. Greve & Associates, P.A.—offer free initial consultations. During this meeting, your lawyer can review the terms of your policy as well as any supporting documentation you may have. Depending on the circumstances, they could find that you’re owed money for your:

- Medical expenses

- Vehicle repair/replacement costs

- Lost wages/income

- Pain and suffering

- Diminished quality of life

Navigating the Claims Process: From Negotiation to Settlement or Trial

Your lawyer can independently investigate the crash to prove that the other driver was at fault, calculate the financial and personal costs you’ve suffered because of the accident, and negotiate with your insurer for a fair settlement. If your insurer will not make a fair offer, your lawyer can take them to trial and present your case before a judge or jury.

Selecting the Right Uninsured Motorist Lawyer for Your Case

Are you trying to find the right uninsured motorist lawyer to handle your claim? Look no further than Ted A. Greve & Associates, P.A. Contact us today to get started with a free consultation, and we’ll advise you on your rights and options.