After you have gone through the work of selecting specific insurance coverage for yourself or your business and made sure to keep up with your premiums on time, you never expect your insurance provider to neglect to pay your insurance claims. And if they do, you will be needing a bad faith insurance lawyer in Charlotte.

While it is not common, there may be a time when your insurance claim is denied without a clearly understandable reason. Other times the payments are made unreasonably late or only a fraction of the amount is actually provided. In these situations, it is important to avail yourself of experienced legal aid.

For those in Charlotte, Ted A. Greve & Associate’s personal injury lawyers have helped numerous individuals in similar situations take charge of their situation and get the insurance payouts they had rightfully paid for. If you need a bad faith insurance lawyer in Charlotte, contact us today and schedule a free case evaluation.

What is Bad Faith?

Before you can understand what a “Bad Faith Lawyer” does it is important to understand what bad faith actually is when discussing an insurance case. It is the duty of every insurance company to act in “good faith” and provide fair treatment to their clients.

This doesn’t mean that they are entitled to pay out for every claim they receive. This would ruin the business. They are not allowed to simply serve their own interests and refuse to honor any claims in an effort to boost their profits.

The minutiae of what “good faith” or “bad faith” could entail will be very different from state to state. The fact remains that certain obligations are in place no matter where the insurance company is operating. Furthermore, “bad faith” from an insurance provider can happen no matter what type of insurance policy is in question.

But, there is a state insurance commissioner in place to make sure these things don’t happen. An insurance provider found acting in bad faith may be liable to financial and other penalties.

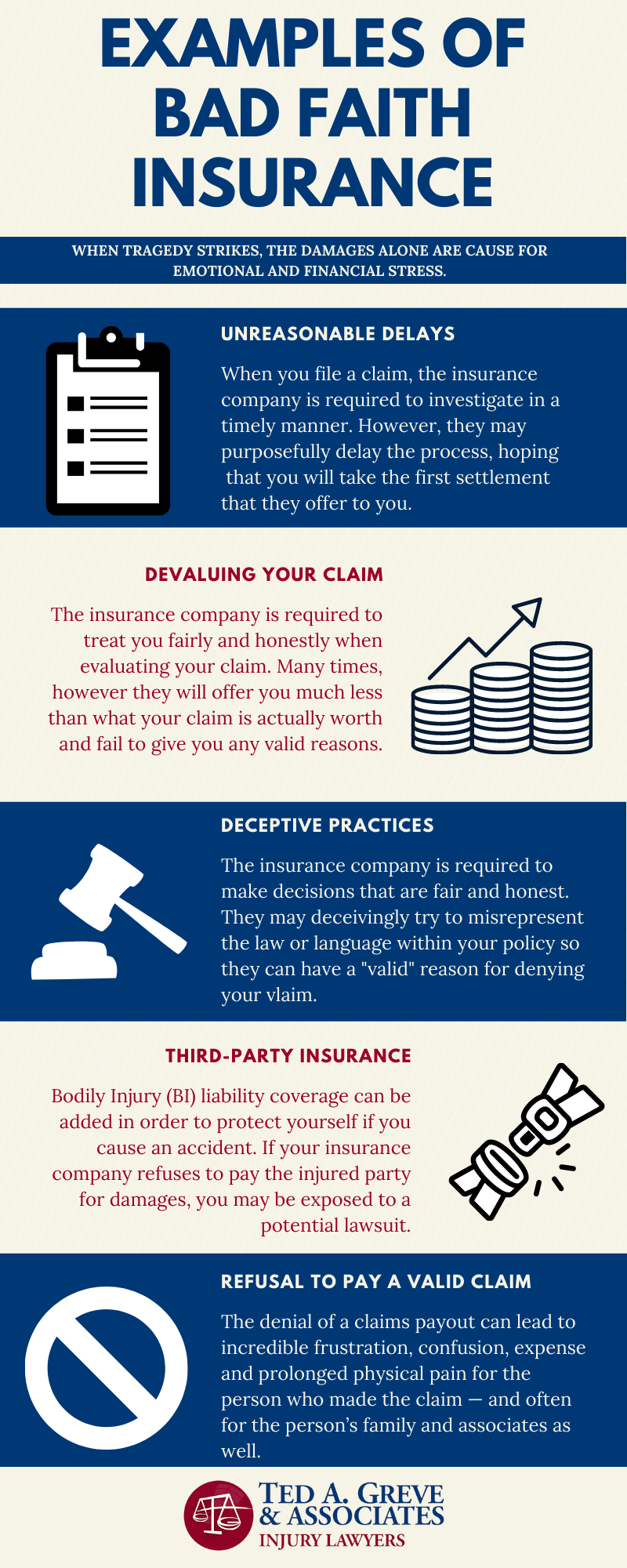

What are Examples of an Insurance Company Acting in Bad Faith?

If you have filed a claim for property damage, physical injuries, etc. or are being sued for something that should be covered by your insurance provider, there are some specific duties your insurance provider must fulfill otherwise thy could be found acting in bad faith. Again, some of these details will be different depending on the state you are in, but these duties basically include the following.

An insurance provider is responsible to:

- Respond promptly to the inquiries and correspondence of their clients.

- Conduct investigations and inquiries into any claims in a reasonable time frame.

- Approve, deny, and pay their client’s claims in a timely or state-specific timeframe.

- Prepare a full explanation after denying claims and point out any policy provisions that justify the claim denial.

- Defend the interests of the insured in any liability action where claims are potentially covered by the insurance policy.

- Pay damages in liability actions as detailed in the policy limits.

If you have found that your insurance provider is failing in any or all of these points and you have already tried to come to a fair agreement with them to no avail, your next recourse may be to seek the help and expertise of an experienced Bad Faith lawyer who can handle all future dealings with them.

What Does a Bad Faith Insurance Lawyer Do?

It is no small task to undertake a bad faith insurance action. The type of lawyers who specialize in these cases put a lot of time, dedication and resources into properly building their case. If you believe you may have a good reason to pursue such a course of action, there are some important reasons to have a bad faith lawyer at your side

Insurance law is complex

The laws vary from state to state, this means that only a lawyer experienced in the bad faith policies of your area will be able to tell you if you actually have a case. Furthermore, the court will interpret these laws differently.

But, all this will be well understood by the experienced bad faith attorney. The laws that say how much is allowed in damages are also different from state to state and only an experienced bad faith lawyer will know what to demand from the very beginning.

The insurance company will be well-equipped to fight your lawsuit

Insurance companies are getting this kind of heat all the time and have become very efficient in their legal responses. They have great reason to fight having to cover claims they deny as they can’t run a business by signing a bunch of checks. Furthermore, they may encourage you to opt-out of the whole legal debacle by accepting a pittance in settlement.

How much will it Cost to Hire a Lawyer for a Bad Faith Insurance Claim?

Here at At Ted A. Greve & Associates, we favor the contingency plan for those facing bad faith insurance providers. This is important as these things tend to happen when bills are high and funds are low.

Contact a Bad Faith Insurance Lawyer in Charlotte at Ted A. Greve & Associates

When tragedy, disaster or injury strikes, the damages alone are cause for emotional and financial stress. Having to convince your obstinate insurance provider to be true to their end of the agreement should be the least of your worries. Your provider is probably already prepared for this and you probably lack the skills, time and resources to make any impact.

If you have decided that bad faith is at play here, then you will need the backing of an experienced injury law firm. Let Ted A. Greve & Associates be your legal representatives in protecting your interests. Contact us today and lets us review your case at no cost to you.