Applying for Social Security Disability benefits often feels like navigating a maze of red tape. The process can be frustrating from the start, with strict eligibility rules, dense paperwork, and long processing times. That’s where a Social Security Disability lawyer in Charlotte, NC, becomes essential.

If you’ve become disabled and need to apply for Social Security Disability or Supplemental Security Income in Charlotte, the lawyers at Ted A. Greve & Associates can help. Call us at 1-800-693-7833 or complete our online contact form today to get a free consultation with a disability lawyer who can pursue the benefits you need.

Understanding the Role of a Social Security Disability Lawyer in Charlotte, NC

Whether pursuing Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), legal support can make a significant difference. From gathering critical medical documentation to organizing detailed application materials, an attorney can present a case that meets the Social Security Administration’s complicated standards.

The SSA has a narrow definition of disability. It is not enough that you have a diagnosis—you must prove that your condition prevents you from maintaining substantial gainful activity and is expected to last at least a year or result in death. This requires clear, thorough evidence of how your physical or mental health impacts your daily life and ability to work.

Legal professionals understand how to frame medical records and functional limitations in a way the SSA recognizes. Their role goes beyond paperwork—they translate a complex life experience into the language of eligibility, helping to reduce errors that can lead to delays or denials.

In Charlotte, local experience matters, too. Familiarity with regional SSA offices, hearing procedures, and administrative judges adds a strategic layer to any claim.

Navigating Appeals: What to Do If Your Claim Is Denied

A significant number of Social Security Disability claims are denied initially. That denial does not mean you are out of options. Many valid claims are approved later in the appeal process, especially with legal help.

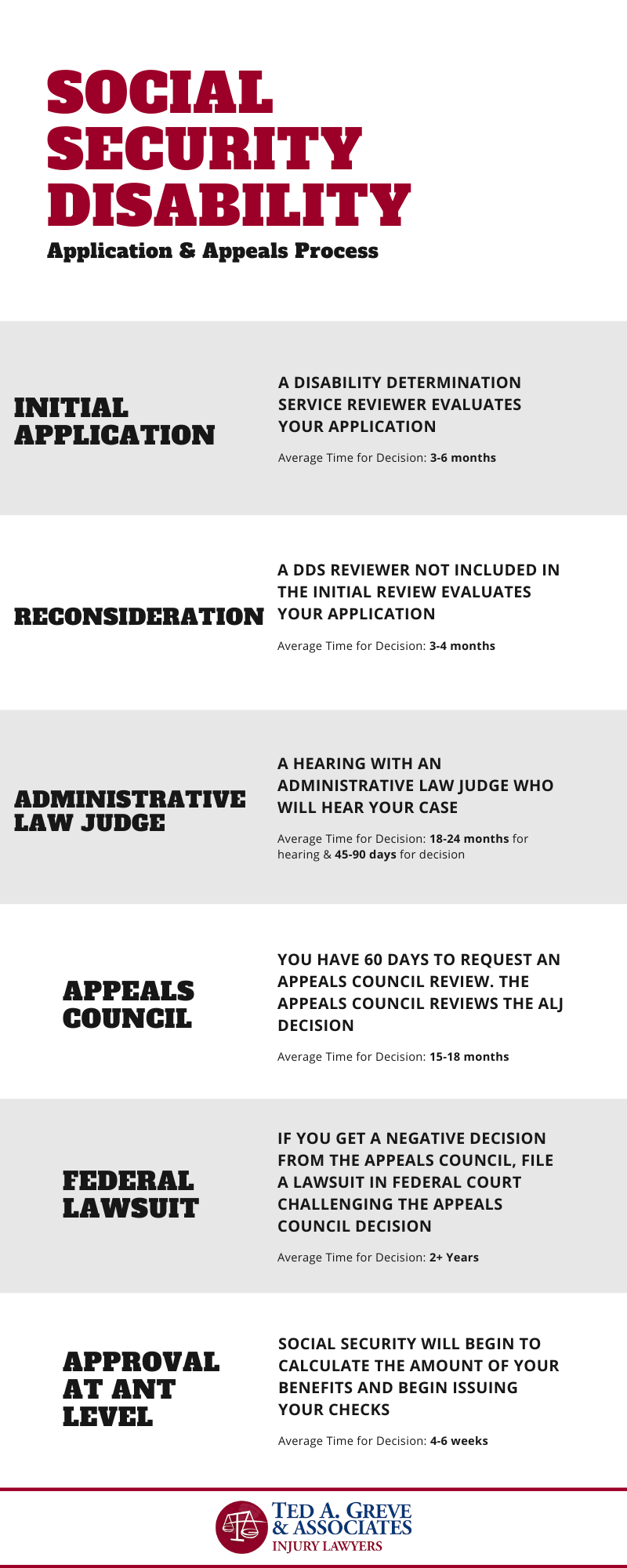

The appeals process includes several stages:

- Request for Reconsideration – This is a full review of your claim by someone who did not take part in the initial decision.

- Administrative Law Judge (ALJ) Hearing – If your reconsideration is denied, you can request a hearing before an ALJ.

- Appeals Council Review – If the ALJ denies your claim, you may request a review by the Social Security Appeals Council.

- Federal Court – If all else fails, a lawsuit can be filed in federal district court.

Each level involves strict deadlines and detailed paperwork. An experienced Charlotte disability lawyer can represent you during hearings, challenge evidence, question witnesses, and present new documentation. We help clients avoid delays and procedural missteps that could jeopardize their case.

The hearing before the ALJ is a key moment in the appeal process. Unlike the initial stages, you can explain your case in person, and the judge may ask questions about your condition, daily life, and work history. We prepare our clients for this hearing by conducting mock interviews and helping them feel comfortable telling their stories clearly and confidently.

Qualifying for SSDI and SSI: Key Eligibility Criteria

The Social Security Administration manages SSDI and SSI, but the eligibility requirements differ.

SSDI (Social Security Disability Insurance) is for individuals who:

- Have worked in jobs covered by Social Security.

- Have earned enough work credits.

- Have a qualifying disability expected to last at least 12 months or result in death.

SSI (Supplemental Security Income) is for individuals who:

- Have limited income and resources.

- Are blind, disabled, or age 65 and older.

- Have not necessarily worked in jobs covered by Social Security.

Both programs require proof of a qualifying disability, including physical, mental, or emotional impairments. The disability must prevent you from performing substantial gainful activity (SGA).

The SSA uses a five-step sequential evaluation to determine if you qualify:

- Are you working and earning above the Substantial Gainful Activity limit?

- Is your condition severe?

- Does it meet or equal a listing in the Blue Book?

- Can you do your past work?

- Given your age, education, and experience, can you do any other work?

This process can be challenging to handle alone, especially if you are unfamiliar with legal or medical terminology. Mistakes or vague descriptions can lead to a denial, even if your condition is valid. That’s why having legal support is so critical.

Maximizing Your Chances: How a Charlotte Lawyer Can Help

Hiring a Social Security Disability lawyer in Charlotte, NC, significantly improves your odds of a favorable outcome.

Here’s how we help:

- We’ll review your case thoroughly to identify any weak points or missing information.

- We’ll gather and organize medical evidence that meets SSA standards.

- We’ll work with your doctors to obtain detailed statements supporting your limitations.

- We’ll handle all paperwork and file appeals before deadlines.

- We’ll represent you at hearings and communicate with the SSA on your behalf.

Many applicants do not realize how crucial the wording in medical records can be. It is not enough for your doctor to say you are disabled. They must explain how your condition limits your ability to perform specific tasks. We collaborate with medical providers to collect clear statements that align with SSA expectations.

We’ll explain the types of evidence the SSA values most, including diagnostic tests, treatment records, mental health evaluations, and functional capacity assessments. We’ll assist you in obtaining this documentation and presenting it effectively.

Our local knowledge gives us a home-court advantage. We know the tendencies of local judges and staff, and we’ll use that insight to shape your case strategy. Whether you are applying for the first time or appealing a denial, we’ll work to put your case in the strongest possible position.

Contact Ted A. Greve & Associates for a Free Consultation Today

If you are unable to work due to a disability, you do not have to handle the Social Security system alone. A dedicated Social Security Disability lawyer in Charlotte, NC, can make the process less confusing and more effective.

Ted A. Greve & Associates offers free consultations for Social Security Disability cases. Let us evaluate your claim and explain your legal options. You have worked hard your whole life—now let us work hard for you. Call our office today to speak with a legal team member, complete our contact form, and get started on the path forward. We are here to support you every step of the way.